Why Defending The Right of States to Charter Banks Without Federal Permission Is Critical

Throughout U.S. history, states could charter banks without federal government permission. Recently that changed when federal bank regulators stealthily voted to give themselves a veto over certain state banks. They did so by purporting to exercise “discretion” to decide which state-chartered banks can open an account at the Fed, through which banks join the U.S. dollar payment system. Of course, without payment system access a bank is nothing more than a vault. That the states remain free to charter banks, and that those banks in turn have access to the payment system, is one important way for states to counter a disturbing trend that originated in Washington, D.C. – the politicization of banking.

Most of us want simple things from our banks: to keep our money safe, to know that we can access our money whenever we want it, and to bank wherever and however we choose to bank. We do not want our banks to become political pawns.

Until a decade ago, it was unheard of that a bank would stop serving entire groups of customers or the people in lawful — if controversial — industries. It was also unheard of that banks would be blocked from accessing either of the two federal utilities in the banking industry: (i) deposit insurance and (ii) the U.S. dollar payment system (which the FDIC and Fed operate, respectively). Indeed, legislative history shows that Congress took great pains to keep the operation of these two utilities standalone and fully separated from the power to charter banks. As a check and balance, Congress wanted all chartering work done exclusively by the states or the lone federal agency that can charter banks, the OCC. Access to the two utilities was automatic for eligible banks, albeit with bank-specific insurance premiums and overdraft restrictions.

In recent years, though, that long-standing paradigm changed. The Fed began to veto payment system access for certain state-chartered banks, thereby overriding the states’ chartering decisions. Entire industries (and some of the people in them) faced the loss of bank accounts in reaction to FDIC pressure on banks regarding “reputation risk” – a subjective standard that factored into a 2013-17 FDIC program called Operation Choke Point. Recently, federal banking agencies have cooperated with a White House policy to move against even the law-abiding parts of the digital asset and fintech industries.

Historically, states have acted as a check against federal overreach in banking. There is a key reason why: the mission statements of state banking agencies usually require them to support both safety and soundness AND economic development, while federal bank regulators do not have economic development within their wheelhouse. This creates a healthy tension and explains why innovation in banking often originates within the states. The Fed and FDIC have no veto power over state chartering decisions.

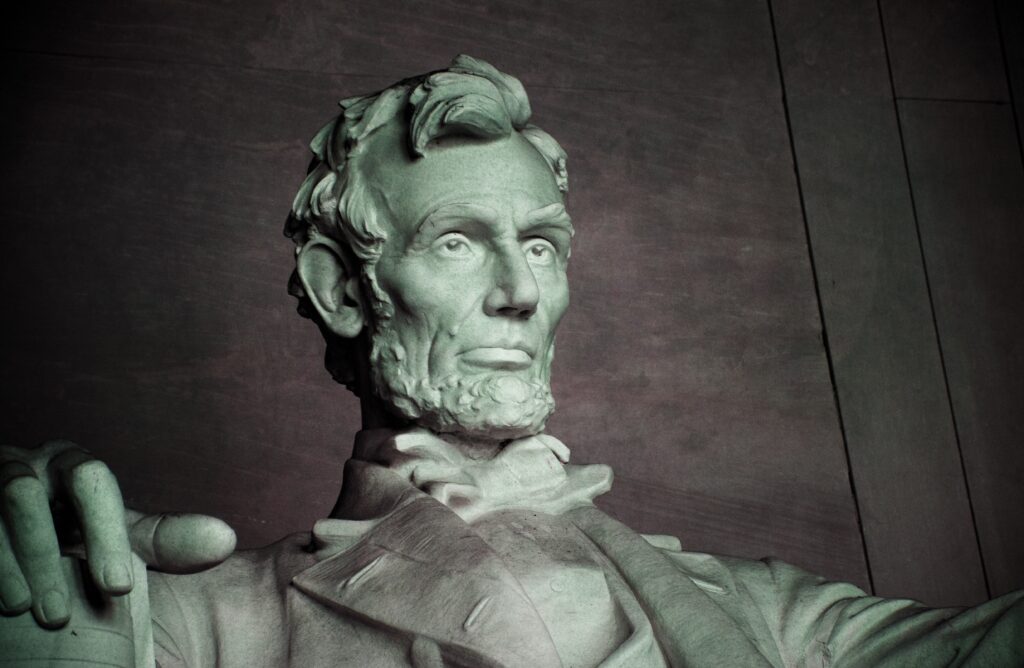

This approach originated with President Abraham Lincoln, who united the U.S. behind a single national currency – the U.S. dollar – in 1863, and enacted a system in which both the states and the federal government have equal power to charter banks (the “dual banking system”). Lincoln created that delicate power balance between Washington, D.C. and the states in banking, and it remained in place for more than 150 years before the recent incursions on it that emanate from Washington, D.C. Congress maintained that delicate balance when it created the Federal Reserve in 1913 and the FDIC in 1933, by choosing to give the Fed and the FDIC exclusive authority to operate their respective utilities but not giving either of them any role in bank chartering. Congress again respected the delicate balance in 1980 when it further clarified the utility nature of the Fed’s role as payment system operator by requiring the Fed to provide services to all eligible banks on a non-discriminatory basis.

In recent years, the usurpation of state power has been the subject of multiple lawsuits against the FDIC (here) and the Fed (here, here and here).

One of the banks caught up in the recent federal dragnet against digital assets is Custodia Bank, a new bank I founded that is not yet accepting deposits. It is a state-chartered bank that was recently denied access to both of the federal banking utilities (FDIC insurance and the U.S. dollar payment system). In denying payment system access to Custodia, the Fed cited Custodia’s lack of FDIC insurance and lack of a federal regulator among its reasons for denial and, in doing so, the Fed improperly created for itself the unilateral power to require all state banks to be both insured and federally regulated.

This overreach is new, and it caused Wyoming’s Attorney General to move to join Custodia’s lawsuit against the Fed’s Board of Governors and the Kansas City Fed. In its court filing, Wyoming’s AG noted the Fed created a “Kafkaesque situation” where a Wyoming-chartered bank is denied access to the U.S. dollar payment system “because it is not federally regulated, even while it is also denied federal regulation.” Wyoming worked closely with the Fed to create its new bank charter, holding more than 100 meetings with Fed officials before the charter went live and the first four banks, including Custodia, earned charters.

Historically, the choice whether states would require their banks to be insured or federally regulated rested solely with the states, not with Washington, D.C, and until approximately 1990 most state laws were silent on the topic. Banks simply chose to be FDIC insured and federally regulated, and the Fed and FDIC routinely granted them access. But five U.S. states held back, keeping flexibility for themselves and a check on potential overreach by federal bank regulators. The five states – Connecticut, Maine, Nebraska, Vermont and Wyoming – enacted bank charters that neither require insurance nor federal regulation. Such uninsured state banks are prohibited from lending (either explicitly by law or functionally), and therefore hold 100% cash to back customer deposits plus up to 8% of deposits as an additional capital requirement.

In other words, the existence of uninsured state bank charters is an insurance policy for these five states to ensure that their citizens and businesses – including politically disfavored ones – can retain banking system access regardless of the whims of the party in power in Washington, D.C.

Federal bank regulators in recent years have upended the decades-old, delicate power balance between the states and the federal government in banking. Congress tasked the Fed and FDIC with running utilities; it did not give the Fed and FDIC veto power over U.S. states – and, in turn, power to block the responsible innovations that state banking authorities create as they fulfill their economic development mandates. By usurping state power, the Fed and the FDIC are politicizing what should otherwise stay an apolitical industry.

Congress tasked the Fed and FDIC with running utilities; it did not give the Fed and FDIC veto power over U.S. states – and, in turn, power to block the responsible innovations that state banking authorities create as they fulfill their economic development mandates.

Tweet

A Brief History of the Dual Banking System:

- States were the only bank chartering authorities in the U.S., from America’s inception until 1863 (except for the U.S. central banks).

- In 1863, Congress created the OCC, a federal bank chartering authority, in the National Bank Act. From that time, banks could choose whether to be federally or state-chartered, and both types of banks equally shared the same national currency system pursuant to the National Currency Act of 1863.

- In 1913, Congress created the Federal Reserve. Among other things, it administers the U.S. dollar payment system.

- In 1933, Congress created the FDIC in response to Depression-era bank failures.

- From 1933 to roughly 1990, most U.S. states did not require their state-chartered banks to be FDIC-insured. Most banks voluntarily became insured.

- Following the bank failures of the late 1980s, many U.S. states chose to require their state-chartered banks to become FDIC-insured (and, consequently, federally regulated). At the same time, three states – Connecticut, Maine and Vermont – enacted parallel uninsured state bank charters to keep flexibility. Of these, Connecticut has been the most active.

- In 1994, Congress enacted the Riegle-Neal Act to enable state-chartered banks to do interstate banking.

- Until Operation Choke Point began in ~2013, FDIC insurance was readily available to all state-chartered banks.

- FDIC insurance was not available to banks serving the digital asset industry, prompting Wyoming and Nebraska to enact uninsured state charters in 2019 and 2021, respectively.

- The Federal Reserve has blocked payment system access to a Connecticut-chartered uninsured bank since August 2017 (TNB) and to a Wyoming-chartered uninsured bank since October 2020 (Kraken Bank), both of which remain pending. In March 2023, the Federal Reserve released its order explaining the denial of both a master account and membership to a Wyoming-chartered uninsured bank (Custodia Bank), defining the new requirement in its order that all state-chartered banks must be insured and must have a federal regulator (either the FDIC or the Fed itself).

- On April 11, 2023, Wyoming’s Attorney General filed a motion to intervene in Custodia Bank’s existing lawsuit to challenge the new Fed requirement that state-chartered banks must be FDIC-insured and federally regulated.

Founder/CEO Custodia Bank. #bitcoin since 2012. 22-yr Wall St veteran. Not advice; not views of Custodia Bank!

Disclaimer

This web site is limited to the dissemination of general information, investment-related information, publications, and links.

Please consult important additional information and qualifications HERE.

View Privacy Policy and Terms of Use

Connect with me on Social Media

Search Posts

Categories

Recent Posts

- How To Keep The Bitcoin Strategic Reserve From Morphing Into A Bailout Fund January 28, 2025

- The Engineering of Bitcoin October 1, 2023

- Here Come The Fintech Banks!! July 21, 2023

- Why Defending The Right of States to Charter Banks Without Federal Permission Is Critical April 17, 2023

- Why Can’t We Just Have Safe, Boring Banks? March 21, 2023