Here Come The Fintech Banks!!

Fintechs have been waiting for years for a U.S. federal payments charter, which has been tried and blocked twice. But a newly disclosed precedent reveals such a charter already de facto exists – and in more than half of the 50 U.S. states, no less. Courts will determine the degree of the charter’s traction in the coming months because the Fed is unlawfully blocking nine applicants that currently hold the charter, and the Fed is facing lawsuits from two of them to force the Fed to comply with the law and let them in.

Background: Why A Version Of The Federal Fintech Charter Already Exists

Five U.S. states have offered uninsured bank charters for a while, and in late June it was revealed that a sixth U.S. state joined the effort by preliminarily approving a payment company to become an uninsured, non-lending bank under its traditional banking law. That state—Idaho—used its traditional bank chartering statute, which enables (but does not require) its banks to be FDIC insured. The charter applicant said Idaho’s bank regulators agreed that its payments-only, non-lending business model did not require FDIC insurance. Roughly half of the 50 U.S. states use similar bank chartering statutes, which allow but do not require banks to be FDIC insured. Consequently, payment fintechs that do not lend – which can already choose from uninsured bank charters in Connecticut, Maine, Nebraska, Vermont and Wyoming – now have up to ~25 more states that could charter payment banks without insurance under their existing statutes, and all it takes is the governors or banking commissioners of any of these ~25 states to decide to follow Idaho’s lead and start attracting fintechs to their states by chartering them as payment banks.

It’s no surprise that the U.S. states would step forward to charter payment banks—because state banking regulators already know how to regulate payment companies. They’ve been doing it successfully for years, albeit under a different license (namely, state-issued money transmission licenses).

What’s In It For The Fintechs?

Two things: streamlining the 50-state licensing process and eligibility for Fed “master accounts.”

First, uninsured state bank charters are portable into more than half of the 50 U.S. states without additional licensure, depending on the bank’s products and customer base. So, becoming an uninsured state-chartered bank would lighten the workload for a payments company licensed today as a money transmitter.

Second, uninsured state-chartered banks are eligible for direct access to federal payments systems via Fed master accounts, which cuts the cost, settlement time and counterparty credit risk faced by payment fintechs that use partner banks today. More on this below.

There are costs, though. Upgrading from a licensed money transmitter to a chartered bank entails a significant increase in required capital, regulatory compliance (higher examination frequency and intensity and stricter Bank Secrecy Act/Anti-Money Laundering standards), risk management, core integration costs and other factors.

But in Europe, some payment fintechs have made the upgrade. Klarna and Adyen, for example, upgraded to bank charters in 2017 in order to speed payment settlement and “displace their banks,” according to Adyen’s CEO. Note that Netherlands-based Adyen leapfrogged all the American-based fintechs to become the only fintech included in the Fed’s initial FedNow participant group (because, as a foreign bank, Adyen was able to back into a Fed master account in 2020 – curiously, though, before it established the U.S. branch of its bank in 2021).

Are Uninsured State Bank Charters The Path To A Fed Master Account For Fintechs?

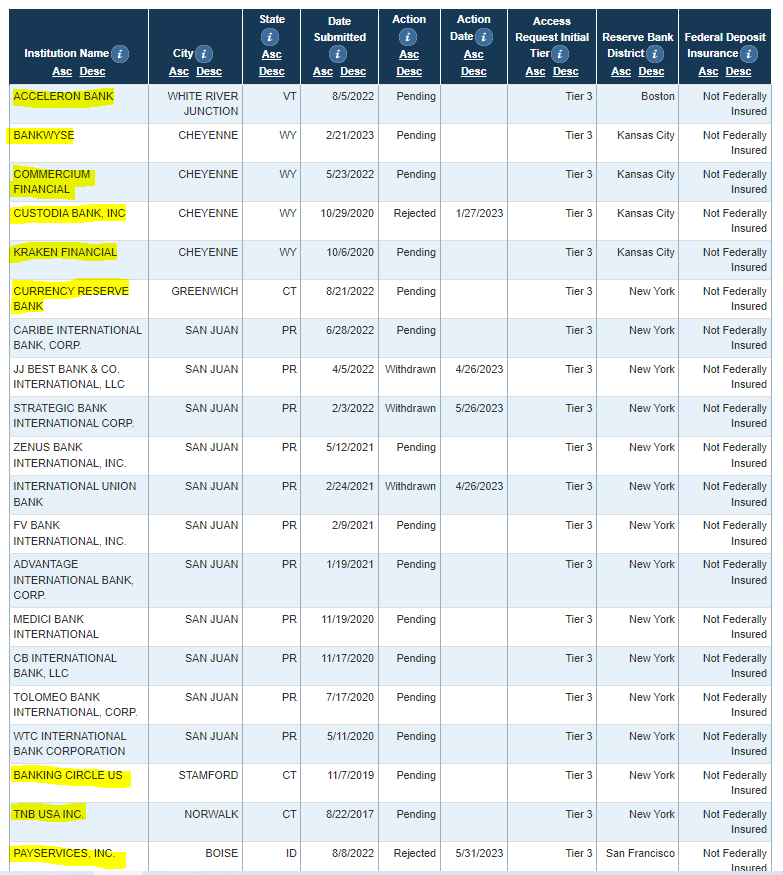

The Fed’s recently disclosed database of master account holders revealed that 414 uninsured entities hold Fed master accounts. It also revealed that nine uninsured state-chartered banks have applied for Fed master accounts. All nine of these payment banks have different business models focusing on payments – some are already operating as fintechs that are upgrading to a bank charter, while others are not yet operating – and they number four from Wyoming, three from Connecticut, one from Idaho and one from Vermont.

The Fed has unlawfully delayed or blocked all nine of these applicants. Two recently denied applicants sued the Fed shortly after their respective denials in recent months (including Custodia Bank, of which I’m the CEO), asking courts to enforce the law that requires the Fed to serve all eligible depository institutions. So now, each time the Fed denies a master account to an eligible depository institution, it’s likely to face another new lawsuit.

The newest lawsuit against the Fed was filed in late June in the federal court circuit that includes California, which is where most U.S. fintechs are based. If this plaintiff prevails, the Fed could see California-based fintechs relying on that precedent to obtain uninsured state bank charters within the Ninth Circuit and become eligible for Fed master accounts en masse.

It’s ironic – and it’s also un-American – that a European fintech was able to leapfrog all American fintechs to become the first and only fintech among the initial FedNow participants, at the same time as the Fed continues to block American payment banks from gaining access. Thankfully, a handful of U.S. states are stepping forward to help solve this problem by chartering payment companies as banks, thereby restoring the balance of power to the states within America’s dual banking system. Now it’s up to the courts to determine whether the Fed must follow the law and let these states’ lawfully chartered – and eligible – banks in.

Founder/CEO Custodia Bank. #bitcoin since 2012. 22-yr Wall St veteran. Not advice; not views of Custodia Bank!

Disclaimer

This web site is limited to the dissemination of general information, investment-related information, publications, and links.

Please consult important additional information and qualifications HERE.

View Privacy Policy and Terms of Use

Connect with me on Social Media

Search Posts

Categories

Recent Posts

- How To Keep The Bitcoin Strategic Reserve From Morphing Into A Bailout Fund January 28, 2025

- The Engineering of Bitcoin October 1, 2023

- Here Come The Fintech Banks!! July 21, 2023

- Why Defending The Right of States to Charter Banks Without Federal Permission Is Critical April 17, 2023

- Why Can’t We Just Have Safe, Boring Banks? March 21, 2023