Is Bitcoin the New Blockchain???

“Bitcoin is the new blockchain”—Andreas Antonopoulos, via twitter, April 12, 2016.

I have a confession. I love both blockchain and bitcoin.

No, that’s not a contradiction, even though the term “blockchain” has come to mean “NOT bitcoin.”

Yes, it’s politically incorrect in my Wall Street circles to admit that I love bitcoin, but I think you’ll find that my reasons are quite mainstream. Let me share knowledge gleaned from a 22-year career in investment banking to explain why it’s possible to love them both.

I believe companies will ultimately evolve to use bitcoin-based payment systems for pragmatic—not ideological—reasons, because:

- bitcoin is global money

- macroeconomic factors will likely push companies toward cash and foreign exchange alternatives that do not expose them to counterparty risk, and

- the bitcoin industry will solve the challenges that have slowed its adoption, including regulatory compliance, user experience and illiquidity.

- Bitcoin is Global Money

Treasurers of global companies face multiple “pain points” caused by the fact that global money hasn’t existed, which means they have no choice but to use Byzantine ways to move money around the world today. Such pain points include:

- managing several hundred bank accounts (in dozens of different banks) around the world

- reconciling them every cycle

- dealing with trapped corporate cash in these myriad bank accounts, while payments clear

- financing periodic collection delays on accounts receivable due to payment system latency

- optimizing transaction costs in the opaque foreign exchange market

- losing visibility of their money after sending a SWIFT payment, until it arrives

- dealing with inability to see where the company’s cash and collateral are in real-time, and

- being captive to the company’s cash management bank, which is often also the biggest lender to the company.

The corporate treasury function for global companies would be much simpler if global money existed, because all of these pain points would be alleviated or solved.

Global payments in the present system require at least three jumps to arrive: first from the payor’s bank to its central bank, then to the central bank and then the bank of the recipient.

Actually, an alternative “global money” already exists, and it requires no jumps to move money internationally. It’s called bitcoin. Its plumbing is inherently superior for international payments relative to current alternatives because its transactions settle nearly instantaneously, which makes it interesting as an intermediary currency for foreign exchange.

Although the U.S. dollar today acts as an intermediary currency for a large portion of foreign exchange markets, the U.S. dollar is not global money because all dollar payments still must settle at the Federal Reserve every night. This means non-U.S. banks must clear their dollar payments through a partner bank in the U.S. (called a “correspondent bank”) that is licensed to settle at the Fed. These extra jumps add time, cost and default risk to foreign exchange.

Companies have strong incentives to use the cheapest services, so I believe that once regulatory-compliant bitcoin platforms can offer cheaper bid-offer spreads for foreign exchange relative to current alternatives, businesses will migrate to using them.

Anecdotally, some companies are already using bitcoin for small-scale FX transactions in some of peripheral emerging markets. I believe the trend will continue.

Why hasn’t it happened faster? Bitcoin’s liquidity, user experience and compliance tools are still too nascent for broad institutional adoption, and applications built on Bitcoin’s platform generally aren’t yet enterprise-ready. But the Bitcoin ecosystem is advancing on all of these fronts. (Note: Bitcoin with capital B is the blockchain—the ledger—on which bitcoin, the currency, transacts.) Bitcoin volume is still tiny relative to institutional payment needs but it’s steadily increasing. Bitcoin’s user experience is improving (way too slowly, IMHO!)—and institutional tools connecting bitcoin-based payment platforms to corporate ERP systems do not exist. Innovators are already working to create regulatory-compliant payment platforms that run on Bitcoin’s payment rails (example here)—no doubt more will crop up.

2. Macro Factors Will Likely Play Out in Bitcoin’s Favor

Four macroeconomic factors, I believe, will converge to make bitcoin a pragmatist’s tool for global payments in the coming years. I expressly make no predictions about either the timing or sequence of events—and therefore am not advising anyone to do anything with bitcoin—not to buy, hold, sell or do anything else with it. Caveat emptor! No investment advice on this blog!

The four macroeconomic factors that I believe will likely play out in bitcoin’s favor are:

- a re-thinking of “what is cash?” driven by negative interest rates, bank bail-ins and money market reform,

- sovereign credit risk is beginning to undergo a re-assessment,

- corporate treasurers are looking for new ways to free up working capital, and

- a quiet bitcoin revolution is happening in emerging markets, where steadily increasing bitcoin transaction volume is, on the margin, beginning to make Bitcoin’s blockchain a cheaper way for companies—not just individuals—to conduct foreign exchange. What starts on the periphery of the periphery comes to the periphery, and what comes to the periphery ultimately comes to the core.

These trends may take years to play out, but all of them are already in motion. Let’s dig into each trend.

(A) A Re-Thinking of “What Is Cash?”

Mainstream financial markets are already starting to re-think “what is cash?” because of (1) negative interest rates, (2) exposure to bank bail-ins and (3) money market reform. Cash is not a riskless asset—it never has been, even though accounting rules treat it as such. Cash is not meant to fluctuate in value but in reality it does, and I believe we’re in the early stages of recognizing this.

How might these issues affect bitcoin? I foresee companies responding by diversifying their cash into zero-yielding assets that entail some price volatility but avoid negative yields. Bitcoin is just one example of a zero-yielding asset.

Negative interest rates: Nearly 30% of the world’s outstanding government bonds currently trade with negative yields. Banks in these countries are beginning to “fire” depositors by pushing them out of deposits and into riskier securities or by charging high fees, which is functionally the same as paying a negative yield on cash. (I’ve been predicting negative interest rates for years, and continue to do so, because they are a symptom of debt proliferation—and I don’t see that trend reversing anytime soon. The U.S. is likely to see negative interest rates eventually too. But that’s a topic for a later blog post…)

Bank bail-ins: 2016 launched the era of bank bail-ins in Europe, and for the first time many companies are analyzing the potential for a default on their bank deposits. Bank depositors are at risk of not getting their money back in the event of a bank failure because they’re unsecured creditors of banks who rank below secured creditors. Deposit insurance funds (such as the FDIC in the U.S.) would cover retail depositors’ losses, but corporate deposits usually far exceed deposit insurance caps. While bail-in legislation in Europe has garnered headlines, in reality a similar regime has functionally existed in the U.S. since the 2005 bankruptcy reforms—which gave derivatives creditors of U.S. banks a bankruptcy preference. Plain English: derivatives counterparties are first in line to grab the cash of a failed bank, and depositors get what’s leftover. Bank deposits are not riskless.

Money market reform: Money market funds are not riskless either, and beginning this Fall companies will need to mark prime funds to market (as of October 14, 2016) and therefore endure fluctuations in the value of their cash. Money market funds have been a popular cash-equivalent investment because they’ve had a stable net asset value of $1, but that artificial stability always masked underlying price volatility. As of October the SEC will require U.S. institutional money market funds to float their net asset value to reflect the fair value of the fund’s investments (exempting government money market funds). Translation: cash deposited in most U.S. money market funds will fluctuate in value as of October.

These trends are converging with bank regulatory rules that make banks a lot less interested in attracting deposits from corporate clients. Basel III and the Fed’s LCR (liquidity coverage ratio) rules have increased the amount of capital banks must hold in the cash management business. As the banks are forced to increase what they charge customers in this business, companies have more incentive to find alternatives.

So a corporate cash manager increasingly has career risk in the decision where to invest the company’s cash. No alternative is riskless. Costs, risk and price volatility are going up. I believe companies will diversify toward investing their cash in zero-yielding assets, such as bitcoin, despite the price volatility they entail.

(B) Sovereign Credit Risk Is Also Being Reassessed

Bitcoin has no counterparty risk. Cash does.

Banks can fail and be bailed-in. Governments can and do default on the short-term debt that many companies hold as cash.

Government credit risk deserves a separate blog post but here’s the upshot: markets are starting to reassess whether government debt is truly riskless, and whether corporate debt is always riskier. It’s counterintuitive, but low interest rates are a sign of building credit stresses in economies in which debt has ballooned (including the U.S.)—and negative interest rates are a sign that economies have very little capacity for new borrowing. Why? Because debt growth in debt-based economies pushes interest rates down, not up. Contrary to what we learned in school, deficit borrowing in debt-based economies does not cause interest rates to go up—rather, the opposite can persist for years, until suddenly the country has no unencumbered assets left to support new borrowing and interest rates spike suddenly as default concerns come to the fore.

What does this mean for bitcoin? Not much—yet. But as debt levels continue to balloon around the world, more sovereign credit risk issues will arise. As this plays out, corporate cash managers are increasingly likely to look for alternatives that do not expose them to sovereign credit risk. Bitcoin is one type of asset that has no counterparty risk.

(C) Corporate CFOs & Treasurers Are Looking for New Ways to Free Up Working Capital

“Lazy balance sheet”—having too much cash and too little debt—is a cardinal sin in the corporate world these days. Activist investors have targeted companies with lazy balance sheets and have had high-profile successes in forcing managements to act or lose their jobs. In most cases the low-hanging fruit has already been picked, so CFOs and treasurers are looking for new ways to free up their expensive capital to make their balance sheets leaner.

How does bitcoin play into this? Answer: companies can free up working capital—substantial amounts, in some cases—by reducing payment latency. Global money, such as bitcoin, would accomplish that. Tied-up working capital is less of an issue for investment-grade companies, whose banks do not require them to hold “comfort deposits” to cover payments. But it is increasingly true for unrated and non-investment grade companies whose cost of capital is high—and going up. Trapped cash is a drag on shareholder value (i.e., it earns no return on capital but the companies have to finance that capital at high cost). Hence, such companies have strong incentives to find ways to release trapped cash.

Here’s how the CFO of Seagate Technology, Dave Morton, described it: “Why should it take me 48 hours to make a foreign currency payment?…I have 10,000 suppliers and handle 100,000 invoices a month. If I could pay people immediately, what kind of a discount would I get?” Seagate has publicly disclosed that it invested in Ripple and is testing Ripple’s technology.

(D) A Quiet Bitcoin Revolution Is Happening in Emerging Markets

While bitcoin has been out of the spotlight, it has quietly but steadily grown. Emerging markets have been key, as bitcoin has become money to some of the ~1 million people who obtain their first cell phones every day. Bitcoin has become the first and only “bank account” for many people in the world via their cell phones.

Why should the developed world care about this? Answer: bitcoin transaction volumes have been steadily increasing. So have its price and the computer resources in its network (“hash rate”). Up and to the right. Much of its growth is coming from emerging markets. This matters to mainstream companies, because as bitcoin transaction volumes ratchet up in markets where banking services are sparse and bid-offer spreads for foreign exchange are wide, bitcoin becomes a viable alternative for corporate treasurers to manage cash flow in and out of those peripheral countries. They are the proving ground where bitcoin’s cheaper, simpler and faster payments are demonstrating pragmatic value.

These markets are tiny by institutional standards today. But they won’t always be.

3. The Bitcoin Industry Will Solve the Issues That Are Preventing It From “Tipping”

I see six things that need to happen for bitcoin-based payment platforms to go mainstream, all of which the ecosystem is addressing and all of which I believe will be solved over time:

- compliance tools need to strengthen, so that regulators and risk-averse companies can gain comfort using the new platforms

- volumes need to increase substantially (and, of course, bitcoin needs to scale over time)

- bid-offer spreads need to decline

- user experience tools need to improve dramatically

- companies need to offer enterprise-quality standards and service for bitcoin-based applications, and

- accounting treatment for bitcoin and other similar assets needs to be on par with that of cash.

In the end, I envision a system in which most people will never know that their money moves through Bitcoin’s plumbing, just as today they do not know how their money moves through central bank plumbing.

A Side Note

I’d be remiss if I didn’t comment that bitcoin is not the only form of global money, and other cryptocurrencies, precious metals or other real assets may supplant it over time. Ripple’s XRP may very well gain traction as Ripple’s non-XRP platform grows within global payments markets. Ethereum’s ether was not conceived as a currency but it may evolve to be used that way. (Again, these are NOT predictions about price or investment advice!)

Summary

Bitcoin started as a niche payment system but stalled at the early stages of consumer adoption in the developed world. Since then, the developing world has quietly but steadily picked up the growth slack. I believe corporate adoption for payments will come next, and then broader consumer adoption will follow—but these stages may take decades.

Yet, I believe the mainstream will eventually come to use bitcoin for pragmatic reasons. It’s just a matter of time. Yes, it’s possible to love both blockchain and bitcoin. And I do!

Bitcoin price (source: Blockchain.info)

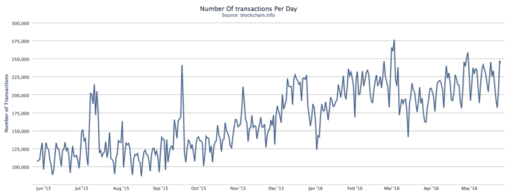

Bitcoin transaction volume (source: Blockchain.info)

Founder/CEO Custodia Bank. #bitcoin since 2012. 22-yr Wall St veteran. Not advice; not views of Custodia Bank!

Disclaimer

This web site is limited to the dissemination of general information, investment-related information, publications, and links.

Please consult important additional information and qualifications HERE.

View Privacy Policy and Terms of Use

Connect with me on Social Media

Search Posts

Categories

Recent Posts

- How To Keep The Bitcoin Strategic Reserve From Morphing Into A Bailout Fund January 28, 2025

- The Engineering of Bitcoin October 1, 2023

- Here Come The Fintech Banks!! July 21, 2023

- Why Defending The Right of States to Charter Banks Without Federal Permission Is Critical April 17, 2023

- Why Can’t We Just Have Safe, Boring Banks? March 21, 2023