Speech to Insurance Regulators: Fixing a Fixable Solvency Risk to Insurers

Slides available here: naic_long_miami_dec2016_vfinal

Thank you to the National Association of Insurance Commissioners (NAIC) for your invitation to speak at your Fall meeting about how blockchain technology can fix a low-probability, but high-severity threat to insurer solvency: lack of beneficial ownership tracking of securities by the securities industry.

Blockchain is not the only solution to this problem, but it is an exciting and complete one!

I care passionately about restoring title to the true owners of securities–in other words, giving asset owners direct ownership in their assets–and this is a major reason why I jumped to a blockchain start-up after 22 years on Wall Street. No, you do not actually own the securities you think you own in your brokerage account!

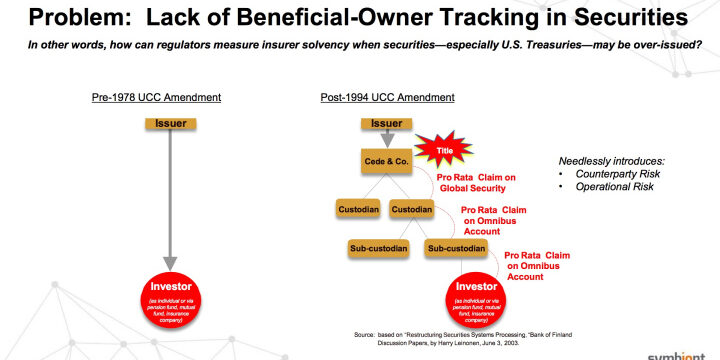

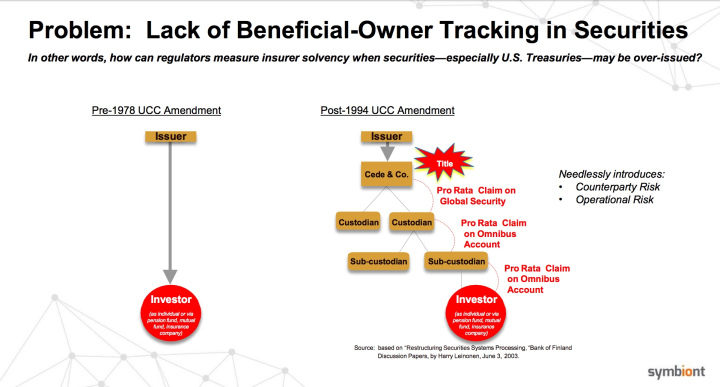

During nearly all of those 22 years on Wall Street, I was fortunate to work in and around the insurance industry and care deeply about its financial health. In the old days during regulatory exams, insurance regulators used to audit the paper certificates held in insurers’ vaults to verify that securities recorded on Schedule D were actually there. This is no longer possible to do today, owing to the indirect manner of securities ownership and the use of omnibus accounts by layers upon layers of securities industry intermediaries. It’s time to go back to the future and restore beneficial ownership tracking–or, better yet, actual ownership of securities by those who think they already own the securities!

With permission from my company, Symbiont, I’ve included my NAIC E Committee presentation slides in this blog post. This is my second speech to the NAIC on this topic, and the first in a public forum.

As Delaware Chancery Court Judge Travis Laster said in a recent speech to institutional investors, “I want you, the institutional stockholders of America, to take back the voting and stockholding infrastructure of the U.S. securities markets…The current system works poorly and harms stockholders…The plumbing needs to be fixed. A plunger exists. The takeover [of securities industry plumbing by institutional investors] doesn’t have to be hostile. It can be friendly. But it needs to be done.”

Indeed, it does.

As I’ve said many times, the biggest beneficiaries of blockchain technology are long-only investors: insurance companies, pension funds, mutual funds, and Mom & Pop investors. They’re the biggest losers from today’s lack of beneficial ownership tracking in the securities industry.

I stand ready to educate and assist the insurance, pension and mutual fund industries in fixing this problem. How can regulators measure insurer solvency when securities–especially U.S. Treasuries–may be over-issued? Even federal securities regulators do not know how leveraged the financial system truly is, because multiple financial institutions report that they own the very same securities at the same time–and securities regulators have no means by which to back out the double- or triple-counting of assets.

Lack of beneficial ownership tracking is a low-probability but high-severity risk to insurer solvency, but it is real.

Blockchain technology is one of many possible solutions to the problem.

Thank you for your interest!

Founder/CEO Custodia Bank. #bitcoin since 2012. 22-yr Wall St veteran. Not advice; not views of Custodia Bank!

Disclaimer

This web site is limited to the dissemination of general information, investment-related information, publications, and links.

Please consult important additional information and qualifications HERE.

View Privacy Policy and Terms of Use

Connect with me on Social Media

Search Posts

Categories

Recent Posts

- How To Keep The Bitcoin Strategic Reserve From Morphing Into A Bailout Fund January 28, 2025

- The Engineering of Bitcoin October 1, 2023

- Here Come The Fintech Banks!! July 21, 2023

- Why Defending The Right of States to Charter Banks Without Federal Permission Is Critical April 17, 2023

- Why Can’t We Just Have Safe, Boring Banks? March 21, 2023